I Scraped 6 Months of NetSuite Job Posts on Upwork — Here’s What I Found

At Cadbury, we’re automating the work that NetSuite consultants do. We believe businesses should focus on growing, not managing another team of consultants.

Before we started Cadbury, I knew I needed to better understand the labor, namely:

Where it is sourced (eg talent marketplaces, Oracle’s SI partnership system, etc)

How it is performed (defining the activity map of a consultant, run process engineering)

Rating the value is exchanged (connect dollars to problems solved)

In this article, we’ll talk about the first point. Where labor originates reveals a lot about the labor itself, and how to capture + automate it.

Where NetSuite labor is sourced

For most companies, the story begins with an engagement with Oracle. Once you hear their pitch and sign the deal, you have two choices: work with Oracle’s in-house implementation team or work with one of their preferred Partners. At this point, an implementation begins which emits a ton of NetSuite consulting labor, usually months of it. The labor continues after go-live, and if the implementation partner is lucky, they’ll get to capture it too in the form of a retainer contract.

Oracle holds a ton of power here, and winners in our space will need to either (1) reach companies before they arrive to Oracle or (2) convince companies that they are the best consulting partner to deal with.NetSuite serves several verticals, which means its labor is highly specialized. You will see SIs setup shop at conferences that hit their strengths, whether its e-commerce conferences like Shoptalk or manufacturing ones like IMTS.

These represent an opportunity for SIs to differentiate themselves, and build an IRL connection with a customer. And the ROI is pretty simple - in talking with attendees at SuiteWorld, it costs ~$50k to get a booth + fly the team out. One light implementation, and you’ve made that back.Once a company breaks ~100 in headcount, I typically see them move NetSuite work to an internal role. Couple factors at play including high volume of labor, low latency requirements around maintenance + reporting, and trust/security. These companies will recruit on their own, or rely on specialized talent firms like SystemsAccountants & Anderson Frank to help.

Talent marketplaces, especially Upwork, dominate the economy of freelance NetSuite labor. Whether it’s non NetSuite services company looking to do staff aug, or companies exploring outside options for help, Upwork is the place for it.

It’s the go-to place to find offshore talent, and because of that, there’s wage pressure. On the buyer side, you get cheap prices with the tradeoff that it’s all DIY; it’s on you to define the task, interview talent, and manage them.

So what does NetSuite labor on Upwork look like?

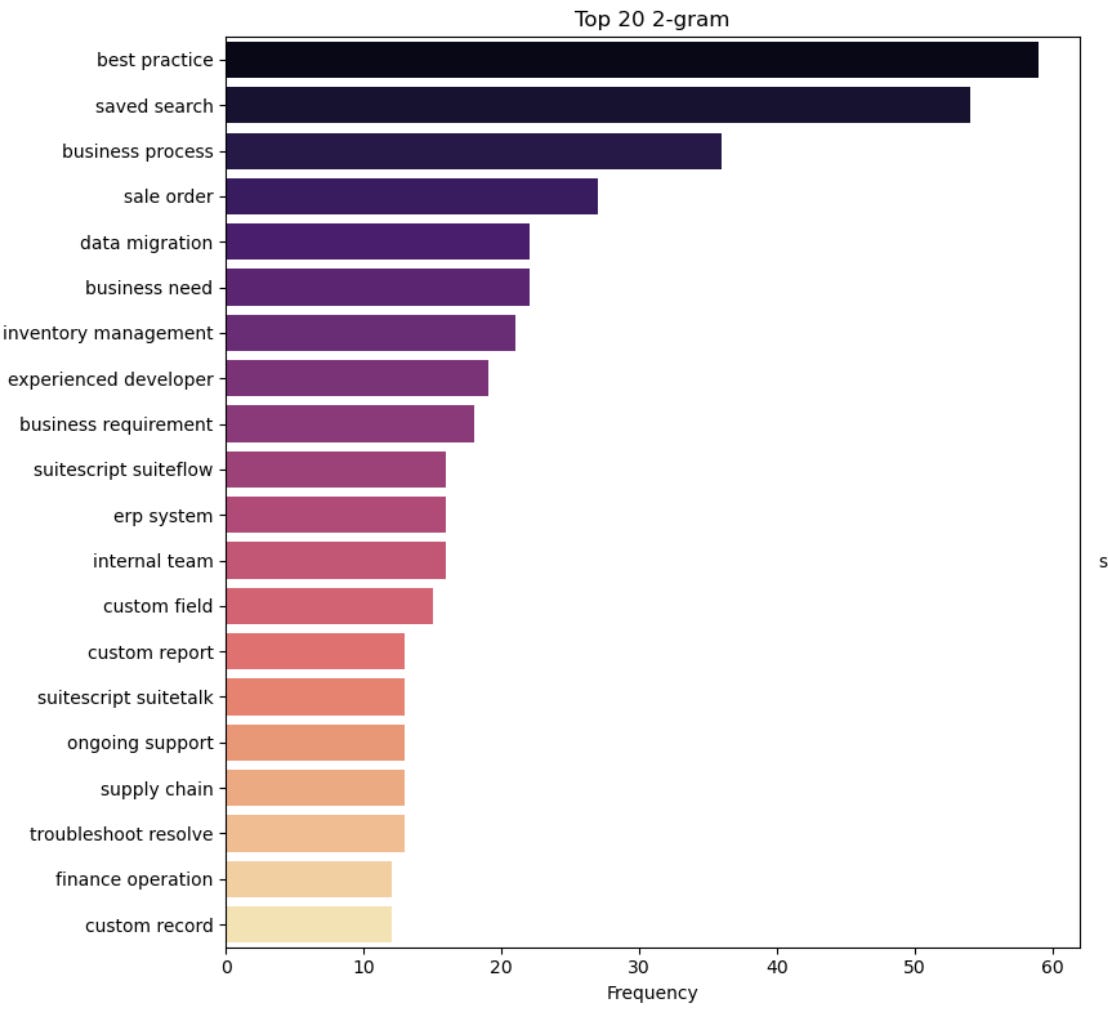

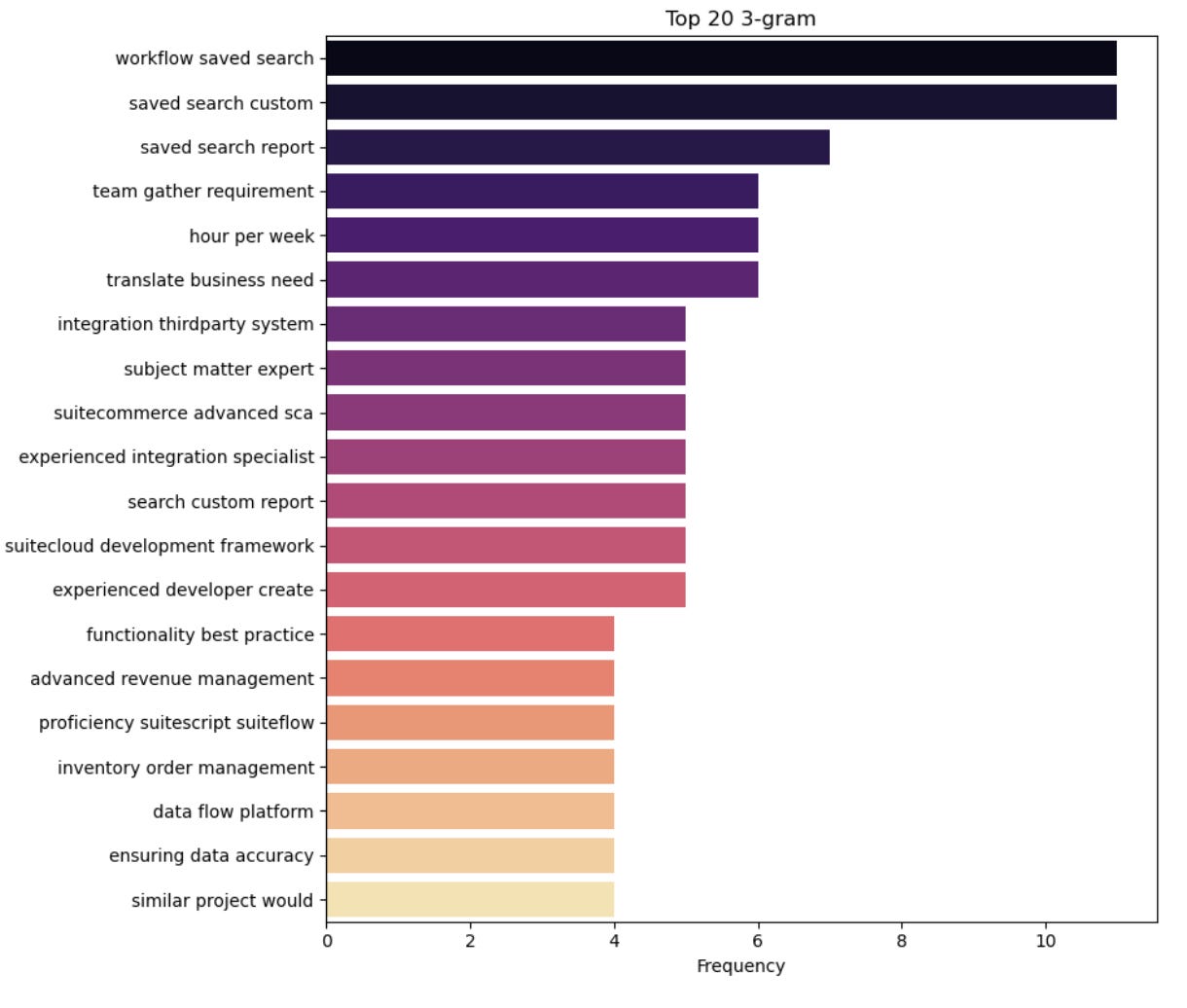

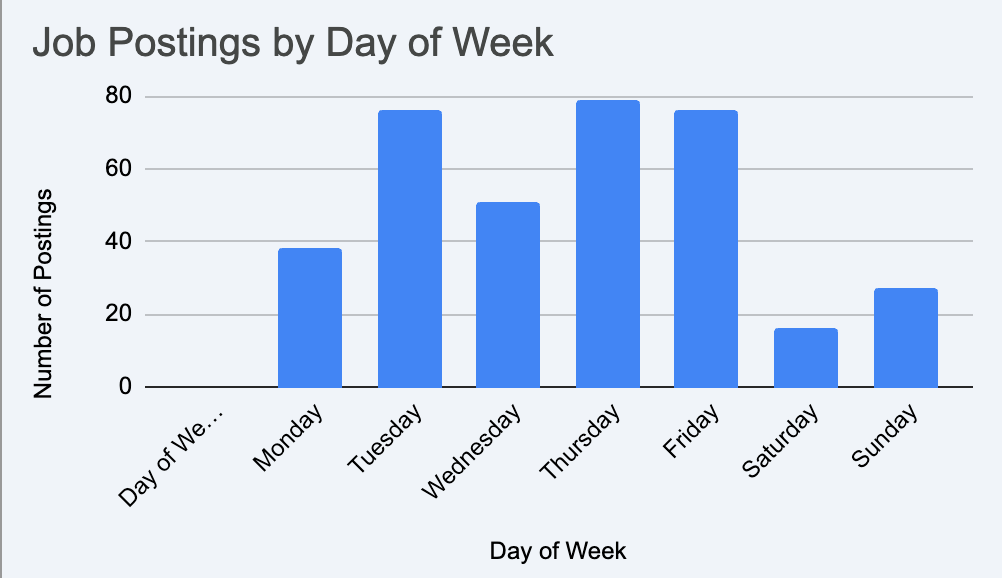

Between March and August 2025, we scraped 363 NetSuite posts off Upwork (using a freelancer of Upwork, of course). We pumped this data into a SQLite db, built a Jupyter notebook, here’s what we saw1:

In the future, we could probably filter out even more words (especially ones that come up autogenerated) to get more signal. Still a little too noisy for my taste.

And in case you’re interested in performing your own analysis, here’s the full scraped data. Share your findings in the comments!

The visualizations were performed on a cut of the data that ended in early July. I don’t think it takes away from the conclusions, but FYI to the reader.